September 6 Public Hearing On Midlothian Tax Rate

MIDLOTHIAN – The Midlothian City Council and staff have had a few hurdles this budget season.

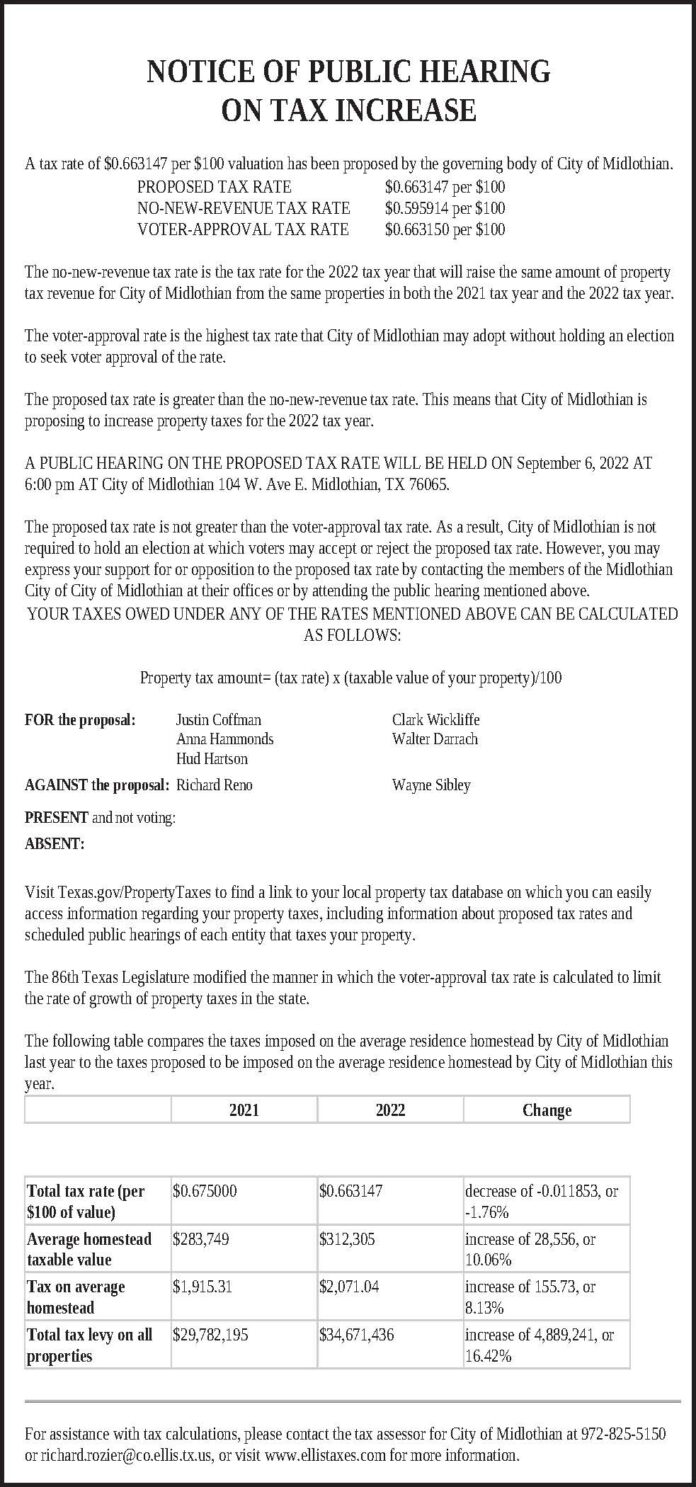

Meetings and workshops, including time spent at last month’s regular city council meetings to discuss the city’s new tax rate as well as budget numbers, have had to be re-discussed after Midlothian City Manager, Chris Dick released a statement that at the August 9 council meeting the Council approved a tax-rate ceiling of $0.663147 for fiscal year 2022-23, which was inaccurate.

“At that meeting it was presented that the No-New-Revenue tax rate was $0.663147,” a release from the city informed. “It was discovered after the meeting that the No-New-Revenue tax rate presented was inaccurate. When the error was caught, it was corrected in the subsequent Public Notice published on the city’s website and in local publications; however, it has understandably caused public concern. The correct No-New-Revenue tax rate is $0.595914 per $100 property valuation.”

It was also pointed out that proposing and publishing a tax rate is only the first step in the City’s process for approving a new tax rate. The city is required by law to propose a tax rate, which in this case is a proposed tax ceiling.

More details were discussed at the City Council meeting in late August and at a City Council workshop earlier this week. Midlothian Mayor Richard Reno reminded council at this week’s workshop that the single most important thing they needed to do was to direct staff relevant to the overall tax rate and related topics.

“This is to set the stage for the September 6 public hearing,” he said.

Pursue An Alternate Funding Source For One Time Expenditures

More discussion was had during the workshop and Midlothian Mayor Pro-Tem Justin Coffman said of the final decision after over two hours of meeting. “The direction that the council ultimately gave the city manager was to pursue an alternate funding source for roughly $550,000 worth of big ticket, one-time expenditures from the budget. If that approach is approved Tuesday [September 6], this would lower the rate to .65. If this approach is not approved, then we will have a different tax rate.”

Initially at the workshop there were comments about various options the city provided council to consider.

Coffman said early on at the workshop that he still would like to see council find room on the tax rate to lower it a little bit and to do so by going with an option to take $660,000 out of the M & O side whether it be through the added staff positions council recommended or otherwise.

“That would give us a no new revenue rate on the M & O side,” Coffman said. “On the debt side of the tax rate I feel like the voters spoke when they approved the bonds so I am good with where the debt side sits but revisiting the idea of dropping the M & O side.”

Place 4 councilmember Clark Wickliffe said he was proposing to stay with the rate they are already lowered to adding “there are other projects that are going to require the use of fund balance and I am nervous to keep taking that from fund balance when I know we have other projects coming.”

Both Reno and Councilmember Place 1 Wayne Sibley agreed with Wickliffe on this comment.

Reno said “We should hold to what we said was the maxed rate of .663 and for that the voter approval rate for M & O.”

Options Include Reviewing Budget Again, Removing Positions Added

Coffman reminded there were other options than taking it out of fund balance “we could go through the budget again or consider removing those positions we added,” he said.

Wickliffe said he didn’t have a problem going through the budget again but that he “hates to remove positions in areas where they are already understaffed.”

Added to those comments, Place 2 Walter Darrach added “I will just say there always seems to be money to spend on what we want to spend money on and there never seems to be any money for things we don’t, so I am not in favor of removing the six staff positions regardless of how the tax rate is set.”

Staff has their work cut out for them as they prepare for Tuesday’s council meeting to present the necessary changes to the city council.

Coffman added too, “I think it’s important to mention that nothing has officially been decided, except the max rate allowable.”

The City Council agenda will be published by Friday, September 2 and will show the “proposed” tax rate of $.65 as directed by Council at this week’s workshop.

“The city council spent numerous hours over the course of five budget workshop meetings going line by line through this year’s budget in order to land on the overall tax rate for 22-23,” Coffman concluded.

“Last year the city of Midlothian had a rate of .67 cents, this year the council has already set a cap rate of 66.3 – meaning this is the highest number that can be adopted. Thus, the tax rate will for sure be lower than last year’s. As a result, we will have lowered the tax rate three out of the last four years. At the Tuesday morning workshop, direction was given to the city manager to proceed in preparing a budget that reflects another tax rate reduction down to .65 cents. This number will be voted on and a final rate will be set at the special called city council meeting on Tuesday, September 6 at 6 p.m.”